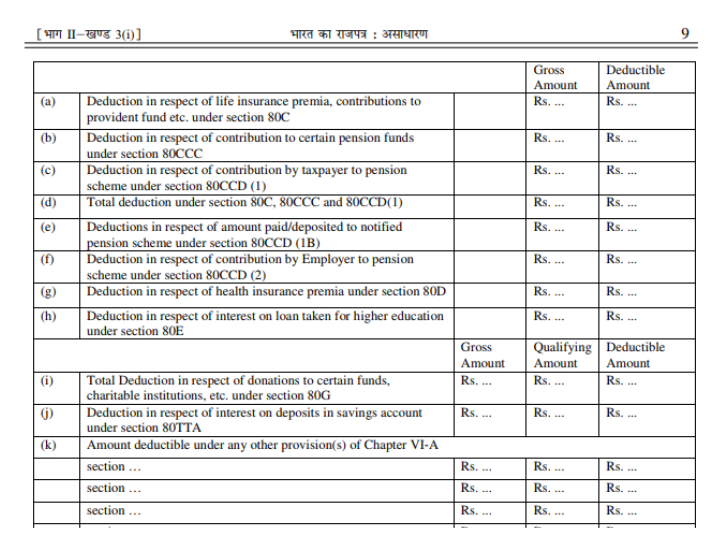

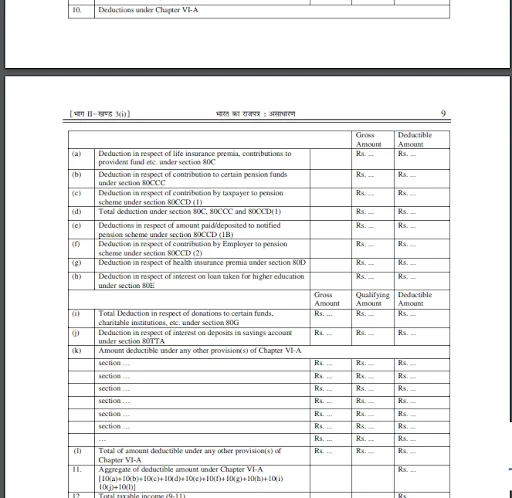

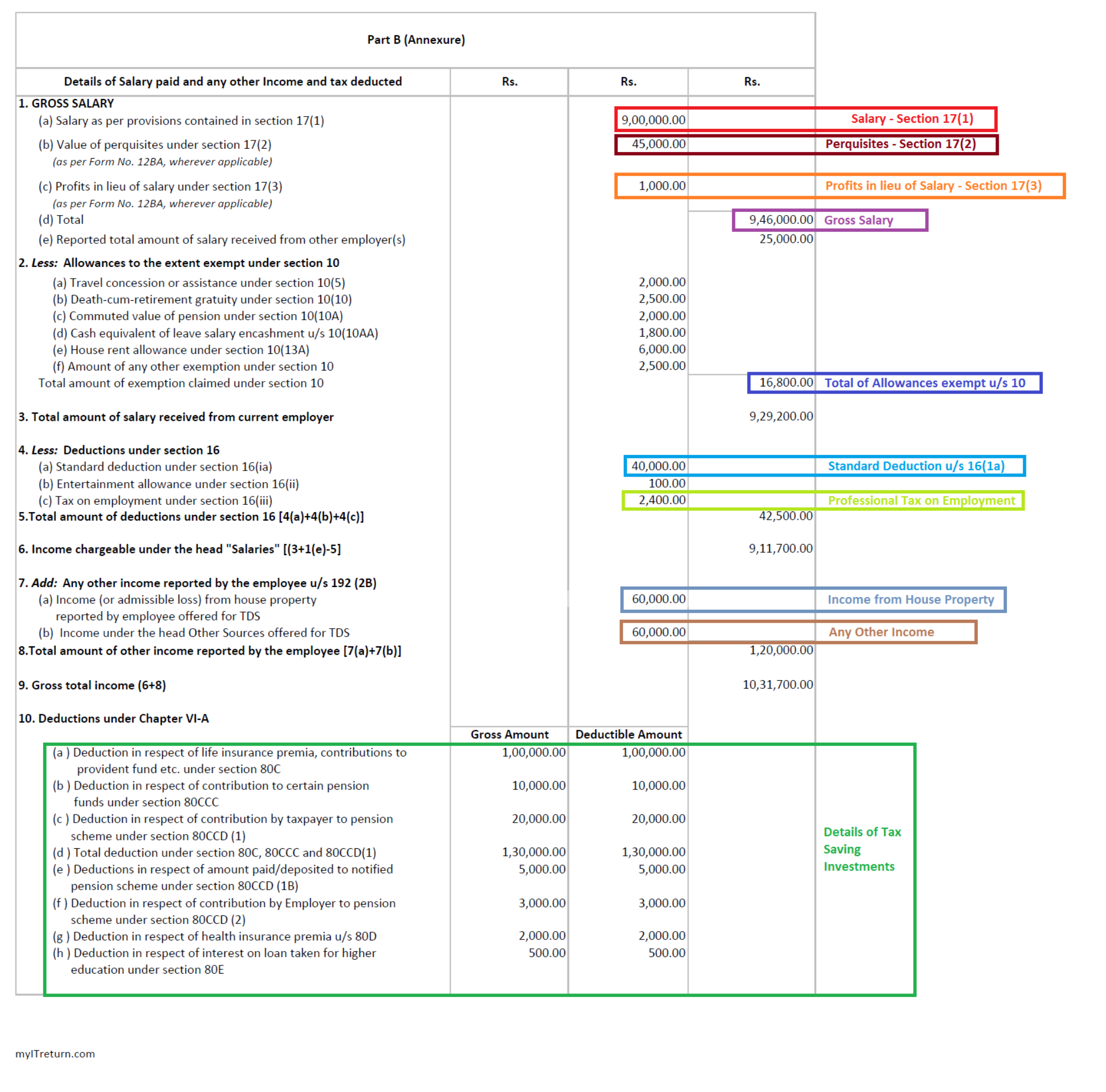

Deduction Under Section 80 C of Income Tax Act with the Automatic Form A16 Part B and A&B ( One by One preparation) For FY 2016-17 – tdstaxindia.net

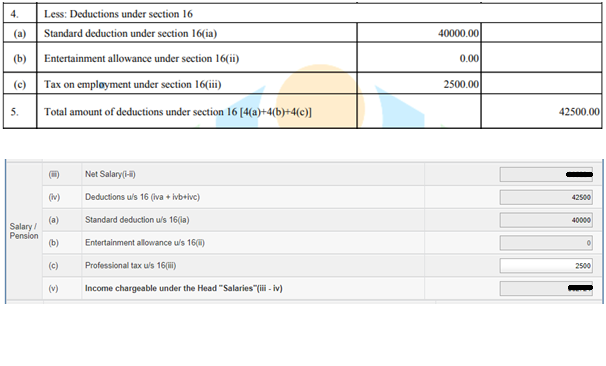

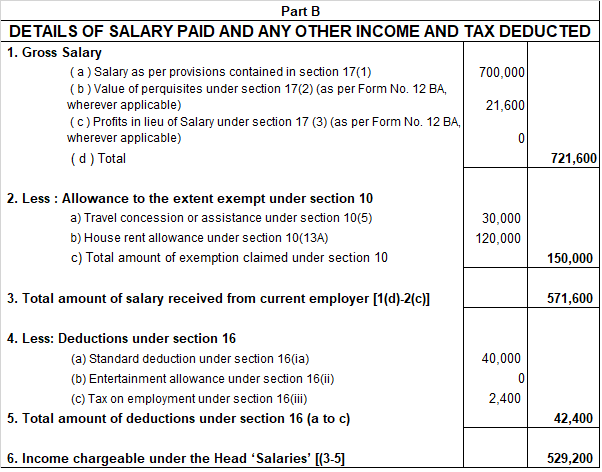

Deductions from Salary | Deduction under section 16 | Standard deduction |Entertainment Allowance - YouTube

Deduction from Salary Sec 16 | Deduction from Salary | Section 16 under the head salary| AY 2021-22 - YouTube

![Computation of 'Salary' Income [Section 15-17] Computation of 'Salary' Income [Section 15-17]](https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Salary/Images/How%20to%20Compute%20Salary%20Income.jpg)